Tennessee Debt Relief

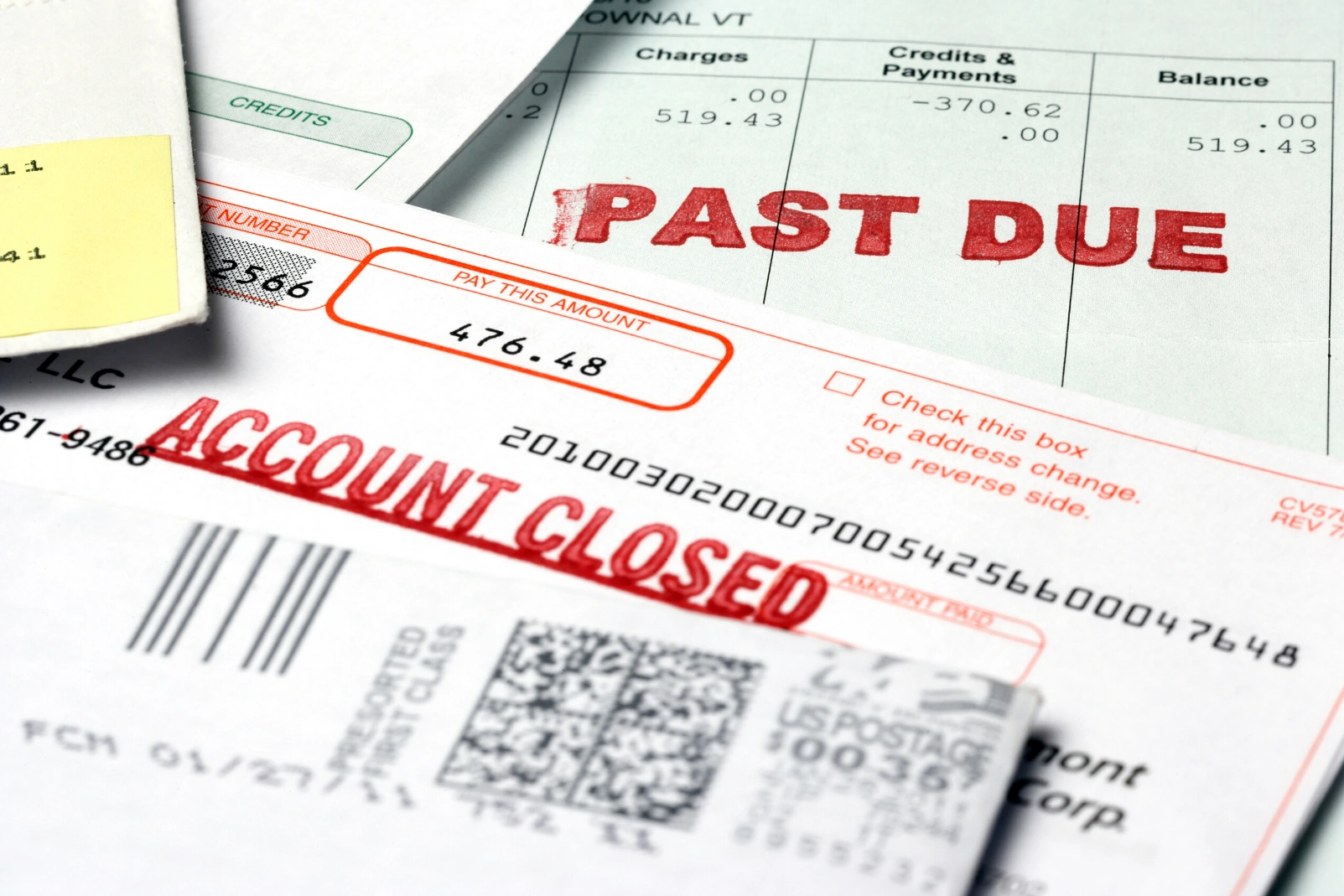

Credit card debts, medical bills, personal loans—lots of things can gradually put you under hefty liabilities.

Our team of debt specialists is trained to conduct an in-depth evaluation of every debt crisis and carry out a negotiation that best serves the interest of our clients. We will utilize every skill and resource necessary to reduce your overall debt and to set up a debt relief plan that is feasible and suitable for your financial status.

Working with us will also lessen or even eliminate your problems with aggressive calls or collection harassment from your creditors. They will be notified that you’ve partnered with us and most creditors tend to be more understanding in this case.

More importantly, you don’t have to worry about costly service fees or hidden charges. Optimal Debt Solutions serves with full transparency and dedication to helping our clients truly achieve their financial freedom!

Call Optimal Debt Solutions at (615) 502-4182 for your Free Evaluation with a Tennessee Debt Relief specialist!

Dramatically Reduce Your Debt

Although debts can understandably stress you out, do not just wallow in regret and worry. You should look for efficient ways to help alleviate your financial crisis, preferably by working with an expert Tennessee debt relief service provider.

Optimal Debt Solutions is a trusted debt solutions finder that aims to lessen the financial burden of all our clients. If you choose to work with Optimal Debt Solutions, we will start by meticulously evaluating your situation so we can come up with a debt relief plan that suits your financial capacity.

We are serving hundreds of clients every month, and all of them benefit from a reduced liability. Our goal is to give you up to a 50% reduction in your overall debt, probably more if the situation allows.

And even if the reduction won’t be that big, we guarantee significant savings that could help you regain financial stability in the long run. We don’t even charge costly service fees or any hidden fees, so it won’t add to your burden!

Debt Settlement Vs. Debt Consolidation

Two of the most frequented debt relief options are debt consolidation and debt settlement. They each have different benefits and drawbacks, so be sure to discuss them with our Tennessee debt relief experts before choosing.

Debt consolidation is the process of getting a new, larger loan in order to pay all your other existing creditors. This aids in easier credit management since you only need to make one monthly payment to satisfy your liabilities. You can get this new loan with a better interest rate, so your debt can somehow be reduced.

However, it can be hard to find creditors who are willing to grant you a better rate if you’re already involved with lots of other creditors. Also, this option can’t substantially reduce your debts since you’re essentially just taking a new loan to fund your debt payments.

Debt settlement, on the other hand, gives you a chance to cut your debt in half or more. This is achieved by negotiating with your creditors to convince them that you’re in a financial crisis and you can’t afford your debt in full. What you will do, if they approve, is pay a much lesser amount in a lump sum, or sometimes installments.

However, despite getting your debts reduced and having a feasible payment plan, you will have a problem with a poor credit score. This will hinder you from getting loans in the future.

To be sure what’s best for your case, talk to our debt specialists for an assessment and recommendation. We will even provide some credit counseling to help you avoid further overwhelming debts!

Effective Debt Relief Negotiation

With years of experience and training, our Tennessee debt relief specialists have already seen and dealt with various cases of debt problems. We understand that no two circumstances are exactly alike.

Our process begins with a careful evaluation of several crucial factors, including your number of creditors, total debts, current assets, and potential income. From there, a debt relief plan will be drafted and get negotiated with your creditors.

One advantage about working with us is that Optimal Debt Solutions has established good relationships with creditors all over the state and some across the country! With our negotiation skills and the trust we’ve set, you have a higher chance of getting the maximum reduction on your debt and a more manageable payment agreement.

More importantly, we will help you practice good financial management skills so you will stay consistent with your payments and won’t be in the same debt trouble in the future.

Tennessee Debt Relief Company

Talk to us today, and let us help you get that financial stability back as efficiently as possible!

Call Optimal Debt Solutions at (615) 502-4182 for your Free Evaluation with a Tennessee Debt Relief specialist!